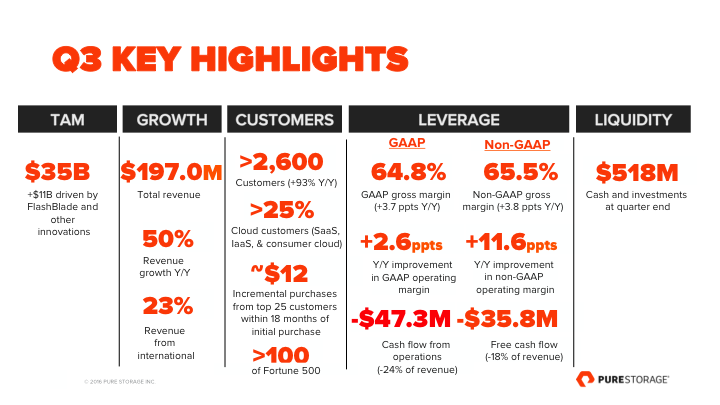

Q3 2016 revenue was $197 million, beating our top-line guidance by 3% and maintaining our remarkable growth. At the same time, we continued to progress toward profitability with non-GAAP operating margin of -9.8%, an eleven point improvement year over year, and more than five points ahead of the mid-point of our guide.

How is Pure winning share and driving leverage in a rapidly evolving storage market?

Notes on Q3 2016

We enable customers to derive unique value from their most strategic data. According to research commissioned by Pure Storage, nearly 80% of businesses believed they could improve their top lines by at least 20% simply by more effectively mining insights within their data. Advances in predictive analytics (including machine learning and streaming real-time analytics) depend on ever more performance intensive access to growing and changing data sets. The more insights that can be mined from the data, the smarter and more agile the business can become.

Through Pure’s unique combination of scale, speed and low total cost of ownership, more applications can share larger datastores, for example allowing analytics applications to be executed online using the same transactional data that runs the business – that is, making all data available to all applications. And by pioneering ways to more efficiently scale and use data, Pure is unleashing innovation in business logic, enabling the development of a new class of data demanding applications. Looking forward, the innovations we have teed up for both FlashArray and FlashBlade will make Pure an even better platform for a business’ most critical data.

We are expanding quickly into unstructured data. FlashBlade is designed to revolutionize unstructured and semi-structured data platforms the same way that FlashArray transformed the market for structured data. Early customer feedback confirms that FlashBlade delivers unprecedented performance in a compact and cost-effective form factor due to its highly innovative design. Recent customer successes range from online computer gaming and medical testing and diagnostics to utilities and energy. For example, CUProdigy, a provider of private cloud solutions for credit unions, is using FlashBlade to elastically scale operations transparently to their applications; and Paylocity is employing FlashBlade to support its SaaS payroll and human capital management software.

While revenue from FlashBlade won’t be material this year, we are on track both for general availability later this quarter as well as for validation of target vertical use cases. FlashBlade contributes to the expansion of our addressable market to $35 billion. FlashBlade is the only all silicon storage platform built from the ground up to accelerate unstructured and big data applications, positioning us uniquely well to take advantage of the decreasing cost of flash and the inevitable demand for greater speed.

We are pioneering another performance breakthrough in data. After all-flash, the next quantum leap in data performance is a protocol designed for solid-state called non-volatile memory express (NVMe). We believe all-NVMe will be a big as all-flash, and more difficult for our legacy competitors to deliver. NVMe provides the potential for a hundred-fold improvement in the parallel processing of data—superseding disk protocols designed to do one thing at a time. Extended across the network, NVMe will do away with locality constraints, enabling applications within a rack or cluster to access petabytes of data as if it were a local resource (providing a more scalable alternative to the server-local storage or DAS model popular in many cloud-native applications).

Moreover, only NVMe provides sufficient bandwidth to exploit today’s larger, more cost effective SSDs – as data center flash modules have grown from 256GB (when Pure got started) to between 8 and 32TB today, legacy disk arrays have not kept pace. This results in an up to 128-fold reduction in I/O per GB that is like trying to drink a lake through a straw.

Pure has been shipping NVMe in our FlashArray//M product since 2015, and is ensuring customer investments are protected in route to the all-NVMe future. Our competitors, leading with solutions designed for mechanical disk, face what we believe will be a multi-year rewrite to deliver the parallelism afforded by flash and NVMe, and their customers still need to buy wholly new storage and perform a complicated data migration, making it an uphill battle to sell storage today that will be obsolete tomorrow. We expect our NVMe leadership to be a key differentiator for Pure as all-flash arrays becoming all-NVMe as well.

For further color on Pure’s technology roadmap, please check out the latest blog from our head of product, and to learn more about NVMe technology and why it is so important, watch next week’s episode of Outside the Box, our web show on storage innovation, which is going to be all about NVMe!

We are shaping the future of data storage with our software driven on commodity silicon approach. Our software driven architecture using merchant silicon makes Pure the optimal data platform today: FlashArray and FlashBlade are the fastest, most dense, most reliable and most cost effective storage in the industry. Our arrays are built from the latest and greatest hardware components, but software has always been our secret sauce. Pure has >400 patents and pending applications for our software innovations. In fact, Pure’s software was originally built to run on commodity servers, but we then designed custom form factors from off-the-shelf components optimized to run that software.

Pure is not unique in doing so: software driven on commodity silicon has proven successful across infrastructure, with Arista doing for networking and Palo Alto Networks for security what Pure is doing for storage. Indeed, public clouds like Azure and Google Cloud are doing the same. With the lion’s share of our innovation in software, Pure will be ready should continued progress in silicon (fast and economical SSDs, better non-volatile memory like Intel 3D XPoint) make 100% software defined more attractive. On today’s technology, Pure’s software-centric on merchant silicon approach is better across the board than the solely software defined alternatives.

We are winning in the cloud. As data center spend continues to shift from traditional IT to the cloud, Pure is uniquely well positioned. Pure now has over 400 Software as a Service (SaaS), Infrastructure as a Service (IaaS) and “Internet” (consumer cloud) customers, and those footprints are growing about twice as fast as the rest of our installed base.

Pure’s cloud customers are keeping core, predictable workloads in their private clouds for greater performance and a higher quality of service at lower cost. Pure is also winning cloud customers because our platform has supremely low operational overhead, is DevOps capable for the lights out data center, and provides an evergreen business model that aligns with that of the cloud.

Pure’s success in modern data centers is not just versus legacy storage vendors, but also versus next generation hyper-converged infrastructure (HCI). Cloud customers tend to specialize their compute/applications and data/storage into separate tiers so that they can be more efficiently scaled and refreshed independently. Moreover, today’s HCI solutions are optimized for disk with flash caching. Although some HCI vendors have introduced efficiency technologies like data reduction and erasure coding, these are performance-challenged, forcing most deployments to rely on mirroring which is inherently inefficient. The result is that HCI delivers simplicity at small scale but sees the economics break-down at even moderate scale when optimized compute and data tiers become more efficient, performant and reliable. In a recent customer benchmark, one of the leading hyper-converged solutions would have consumed twice the rack space and cost $4M more over 5 years, due to the increased hardware costs, power and data center footprint.

HCI tends to do well where simplicity is more important than performance, resiliency, or economics at scale, and indeed a recent VAR survey found that 67% of HCI deployments were for VDI and remote office use cases. But at scale in the data center, it is converged infrastructure (like Cisco and Pure’s FlashStack) that affords the best performance at the most compelling economics.

As we plan the next decade of Pure growth, we seek to become the leading storage platform for clouds #4 through #1000. Our success does not depend on winning over hyperscalers like AWS, Azure or Google who typically build their own storage (they are not counted in our $35 billion TAM). To date, we believe Pure is better positioned to enjoy more success supporting cloud customers than either our legacy or modern competitors, and our roadmap is focused on becoming ever more relevant to these deployments in the years to come.

We are winning in the enterprise. Indeed, Pure now counts more than 2,600 customers from across retail, finance, manufacturing, government and healthcare, including more than 100 of the Fortune 500, up ~10% from Q2. With IDC forecasting that 50% of all Enterprise IT will continue to reside in private clouds over the next 5 years, we are able to offer these customers the same flexibility, simplicity, performance and low total cost of ownership that our cloud customers require.

Competition in the enterprise has always been fierce as legacy competitors attempt to protect their installed bases. Nevertheless, our overall win rates held strong, and are on par with where they were a year ago. Proof of Pure’s differentiation can be found in the latest Gartner Magic Quadrant, our industry leading customer satisfaction (audited Net Promoter score of 83.5), and in our recent announcement that FlashArray//M achieved 99.9999% availability (less than 32 sec. of downtime per year, and in Pure’s case without maintenance windows) in its first year of availability.

Given our strong win rates, Pure’s success is ultimately gated on our ‘at bats’ – the number of deals in which we participate. Our channel partners contribute most of those at bats (three quarters of our new logos in Q3). That expanding partner leverage, which now includes global systems integrators, is essential to extending our reach. We’re also seeing strong traction for our FlashStack partnership with Cisco, delivering converged infrastructure that combines best-of-breed servers and networking from Cisco with Pure’s best-in-class storage. With momentum gaining in deployments around the world, FlashStack continues to show triple digit year-over-year growth.

Our business model is leading the industry, too. Pure’s evergreen subscription to future innovation are not only better for our end users, but better for Pure in that we need never compete to re-win the business of happy customers. Similarly, supremely simple and reliable products are not just better for customers, they are also lower cost to support. We get further leverage from our software advantages in data reduction (Pure often delivers 2 to 5 times the value per flash cell of our primary competitors), and hardware efficiencies (for larger configs, we estimate Pure’s street price is below the COGS of some high-end legacy alternatives). As flash continues to commoditize, Pure’s software allows us to play in ever more of the market, and our efficiency advantages enable us to take share even as we build a fundamentally healthy business.

As a result, we are profoundly enthusiastic about the road ahead. Together, we will win by continuing to deliver the best data platforms in both FlashArray and FlashBlade – bigger, faster, simpler, and lower cost to own than any other choices on the market. The management automation and evergreen business model we have pioneered is built for the cloud-first generation. For the majority of our customers that choose the hybrid cloud model (use of both public and private cloud), Pure is also helping to make the orchestration and management of data moving in and out of the public cloud as easy and cost effective as possible. And, the trusted, secure and effortless customer experience we offer is the foundation of everything we do.

Forward Looking Statements. This post contains forward-looking statements regarding industry and technology trends, our unique strategy, positioning and opportunity, our products and related roadmaps (including for FlashArray and FlashBlade), the impact of NVMe, the benefits of our approach and cost advantages, competition, traction with partners, and our business and operations, including our future margins, growth prospects and operating model. Forward-looking statements are subject to known and unknown risks and uncertainties and are based on potentially inaccurate assumptions that could cause actual results to differ materially from those expected or implied by the forward-looking statements. Actual results may differ materially from the results predicted, and reported results should not be considered as an indication of future performance. The potential risks and uncertainties that could cause actual results to differ from the results predicted include, among others, those risks and uncertainties included under the caption “Risk Factors” and elsewhere in our filings and reports with the U.S. Securities and Exchange Commission, including, but not limited to, our Annual Report on Form 10-K for the fiscal year ended January 31, 2016, which is available on our investor relations website at investor.purestorage.com and on the SEC website at www.sec.gov. Additional information will also be set forth in our Quarterly Report on Form 10-Q for the quarter ended October 31, 2016. All information provided in this post is as of November 30, 2016, and we undertake no duty to update this information unless required by law.

Non-GAAP Financial Measures. This post contains certain non-GAAP financial measures about the company’s performance. For the most directly comparable GAAP financial measures and a reconciliation of these non-GAAP financial measures to GAAP measures, please see our earnings release issued on November 30, 2016, which includes tables captioned “Reconciliations of non-GAAP results of operations to the nearest comparable GAAP measures” and “Reconciliation from net cash used in operating activities to free cash flow.”