When a leading storage CTO suggests that their flagship product line is now more suited for capacity than performance, something remarkable is going on. When Facebook speaks of moving all of their data from disk to flash memory, not just the heavily accessed data from the past week, there’s something remarkable going on. And when one of Pure’s longer-term customers, Paylocity, replaces their last production disk array with another of our FlashArrays, going 100% Pure solid-state in their data center, something remarkable is going on.

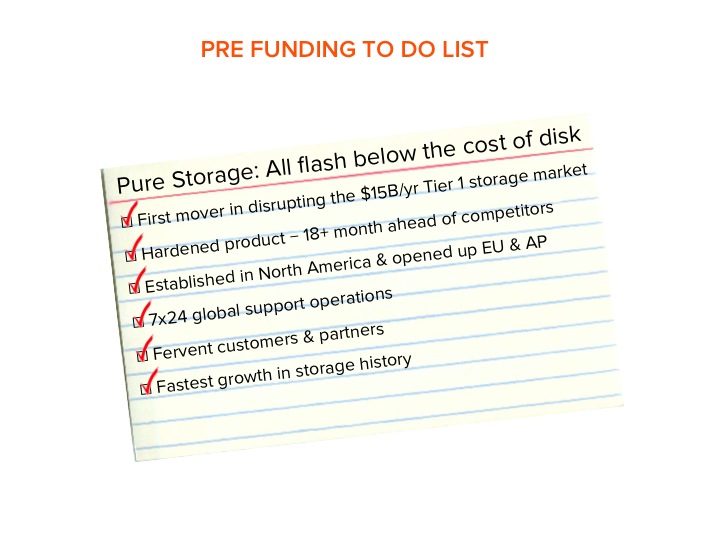

In our industry, technology sea changes combined with disruptive innovation inevitably launch new companies. For storage, the big historical disruptors have been networked storage and file sharing, launching EMC (NYSE:EMC) and NetApp (NASDAQ:NTAP), respectively. Today’s disrupter is the shift from disk to flash. That transition is forcing the rewrite of the entire storage stack following the “all flash at the price of disk” recipe that Pure originated. The good news for Pure is that reproducing our innovations has proved difficult for the storage incumbents—earlier this year, Pure shipped its third generation product while our primary competitors in EMC and NetApp have yet to ship their first generally available releases of XtremIO and FlashRay.

In our industry, technology sea changes combined with disruptive innovation inevitably launch new companies. For storage, the big historical disruptors have been networked storage and file sharing, launching EMC (NYSE:EMC) and NetApp (NASDAQ:NTAP), respectively. Today’s disrupter is the shift from disk to flash. That transition is forcing the rewrite of the entire storage stack following the “all flash at the price of disk” recipe that Pure originated. The good news for Pure is that reproducing our innovations has proved difficult for the storage incumbents—earlier this year, Pure shipped its third generation product while our primary competitors in EMC and NetApp have yet to ship their first generally available releases of XtremIO and FlashRay.

This 18+ month technology lead bodes well for Pure’s mission: we have been ignoring acquisition overtures to focus on building the next great storage company—doing for silicon storage what EMC and NetApp did for mechanical storage. Today, we are thrilled to announce that we have raised $150M, the largest private round of equity funding in storage industry history, and one valuing the company at well over $1B. Joining the Puritan family with this round are leading public market investors T. Rowe Price, Fidelity, and Tiger Global. These are just the sort of investors that Pure would hope to attract to an IPO some undetermined time down the road. We’re equally gratified that our venture investors—Sutter Hill, Greylock, Redpoint, and Index—are adding their endorsement by doing their full pro rata. (And let me add our sincere thanks to Allen & Co., who facilitated this raise and has been a great friend to Pure.)

Today, we are also thrilled to welcome Frank Slootman, CEO of ServiceNow and former CEO of Data Domain, to Pure Storage’s Board of Directors. Frank’s perspective is proving immensely valuable in charting our course given the parallels between Pure Storage and Data Domain, who disrupted the tape backup market with a cost-competitive disk alternative. Moreover, Frank is one of the best CEOs at driving and managing growth.

The backing of these elite public and private market investors is a huge vote of confidence in Pure Storage, validating the

- Scale of our market opportunity;

- Talent of our team;

- Quality of our product;

- Satisfaction of our customers & partners; and

- Health of our business.

Why $150M and why now? Enterprises and service providers are wasting $15B a year buying performance (oxymoron) mechanical disk. The Pure Storage FlashArray is 10X faster, more space & power efficient, reliable, and simpler than the disk-centric solutions it replaces, and yet it costs less! That “no brainer” value proposition has enabled Pure to grow extremely fast, faster to date than any company in storage history, growth that appears to be accelerating as more customers see the business value they can unlock with Pure Storage. This large pre-IPO round of funding cements our position as the first mover and early market leader in all-flash disk replacements.

But while the Puritan team is gratified to have attained critical mass, we recognize we still have a long journey ahead. The storage incumbents want to slow down the all-flash revolution so as to have time to work through their innovator’s dilemmas and control the pace of technology transition. With this large raise we hope to accelerate both our own business and the broader industry’s recognition that mechanical storage (which is now roughly 1000 times slower than its interconnected servers and networks) must be pushed out of the latency path of business. What will Pure use the $150M to accomplish in the years ahead?

- Better serve our customers & partners world-wide – The long-term viability afforded by our new cash position ensures we can protect the investment of our customers and partners. The general rule is that it takes more than $100M to build out a global marketing, sales, and support organization. The vast majority of early-stage companies, even ones with good products, never get there. Self-funding such growth is possible, but would take a decade, and market windows in tech usually close more quickly than that. With the right product, an 18-month technology lead, and a market that is already tipping, it is actually lower risk for Pure to scale our business across all global IT markets sooner rather than later.

- Grow our technology lead – Pure enjoys better than 90% customer satisfaction ratings and our product compares very favorably with those of our competitors, but there is much more that needs to be done: dedupe-aware replication, scaling up to 1/2 PB datasets and beyond, scaling out to millions of IOPS, greater density and lower COGS, greater cloud management automation for the Pure Storage fleet, and tighter integration with our software partners including VMware, Microsoft, Citrix, Oracle, Symantec, and the open source family including Linux, Postgres, KVM, Xen, OpenStack, and so on. This $150M investment will enable us to continue to recruit the best engineers and product leaders to the Puritan cause, putting us in a position to grow our technology lead in the years ahead.

- Set us up for IPO and long-term independence – All of our constituencies—customers, partners, employees, and investors—believe their best outcome is for Pure Storage to be a long term independent public company. Customers and partners love our commitment to their success, and they love that our SE and support team not only has the chops to optimize their transition to flash, but also to troubleshoot broader data center issues in storage networking, software configs, etc. Our employees love the company culture we have crafted together, and love the fact that we are poised to remake the world of storage. And our shareholders know Pure has the opportunity for profound growth, and it would be counterproductive to trade away that upside when so much is breaking in Pure’s favor. Our Board of Directors has helped create more than $100B in public market valuation at companies like Cisco, Workday, ServiceNow, VERITAS, Peoplesoft, Data Domain, and BEA Systems. This is not a group looking for a quick hit.

- Compete against EMC – EMC is the natural competitor for Pure Storage. They bought arguably the second best all-flash storage start-up in XtremIO. When XtremIO becomes generally available late this year or early next, the storage industry leader will have endorsed Pure’s premise that disk-centric performance storage is now legacy, and that it is time for customers and partners to embrace the all-flash future. EMC will enter the market with a richer feature set than most of the early stage all-flash companies with the clear exception of Pure Storage. We welcome our growing competition with EMC: competition drives innovation and customer/partner value, and is essential to growing markets. The additional $150M we now have in the bank positions us to convert our innovations and first mover advantage into sustainable, long-term differentiation relative to XtremIO and whichever of the other all-flash solutions get to critical mass.

Let me close with our sincere thanks to the customers, partners, investors, friends and family members that have made Pure Storage’s first four years (our Birthday is on October) such a resounding success. We couldn’t have done it without you, and we will continue to do all in our power to reward your faith in Team Puritan.

Still think all-flash below the price of disk is too good to be true? Pure and our global network of partners are prepared to back up our claims with a money back guarantee that no customer has taken us up on yet. So if you want to stop throwing good money after bad on mechanical storage, contact Pure Storage or one of our global partners to take the next step toward your future as an all-flash enterprise.