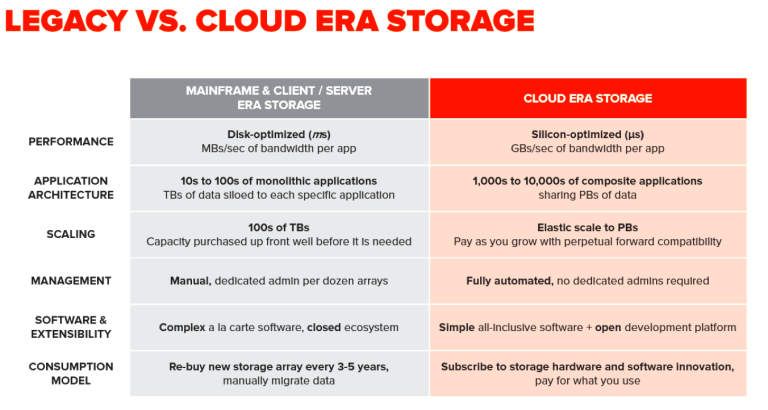

At Pure, we are building a uniquely fast and cloud-capable data storage platform. The 25-year-old mainframe and client/server era technology we compete against simply can’t cope with the explosive growth in data and the need for real-time analysis.

Cloud computing demands a new data platform, one that supports today’s volume and velocity of data and the increasing performance required for predictive analytics and machine learning. Our customers use Pure to accelerate new data-driven applications, mining novel insights about their businesses, while substantially reducing costs and complexity – Pure helps them put data to work for their businesses.

As a result of our innovations, Pure just wrapped up another outstanding year of growth. Q4 revenues were $228 million, up 52% from the year earlier quarter, and above the high end of our guidance range. For our fiscal year, Pure delivered $728 million in revenues, up 65% from the previous year. In fact, Pure’s business has grown 2.7 times over the six quarters we have reported since our IPO in 2015. This year, the eighth since our founding and our sixth of selling, we expect to reach $1 billion in revenues.

At the same time, we continue to progress toward profitability with Q4 non-GAAP operating margin of -2%, a 12 point improvement year over year and more than 5 points ahead of the mid-point of our guidance range, while driving $25 million* in free cash flow. We are guiding that the business will crossover to sustained positive free cash flow in this year’s second half. Meanwhile, our balance sheet remains strong, with $547 million in cash and zero debt – we have everything we need to continue to drive market share gains as the secular shifts to cloud computing and all-silicon storage gain momentum.

Pure added 450 customers in Q4, boosting the total to more than 3,000 customers worldwide. Among the notable Q4 additions:

- Hulu, a leading premium video streaming service, uses Pure to drive its business-critical analytics, and handle intense workloads and customer demands faster.

- Subway, the world’s largest restaurant chain, chose Pure to support the growth of its new online platform for customer orders.

- Royal Philips, a leading technology company focused on innovation in healthcare, lighting and consumer products, is using Pure as the core of its mission critical production, providing effortless management, increased performance and the scalability to grow its business.

- Other new customers include the Australian enterprise services company Optus Business; Japanese entertainment corporation and major gaming company, KONAMI; and cloud based healthcare SaaS company Phreesia.

- Among new FlashBlade customers in the quarter were the National Hockey League, which uses Pure’s technology to help produce original content including online videos and advanced player analytics; law firm Keker, Van Nest & Peters; and geoscience company ION. For ION, FlashBlade helped collapse its storage footprint by nearly 100:1.

*Includes $8.1 million of cash impact related to our employee stock purchase plan

We could not be more excited about the road ahead for Pure, for multiple reasons:

- Data growth is exploding: By 2025, the world will have accumulated 180 Zettabytes (ZB) of data, up from 44 ZB in 2020 and 10 ZB in 2015, according to IDC. (To get a sense of scale, if a byte were an apple, 1 ZB would fill the Pacific Ocean.) Such ever larger data sets are needed for today’s predictive analytics, including machine learning.

- Data stays at the edge: Big data is becoming bigger than wide-area networks are becoming faster, and this represents an interesting opportunity for Pure. With data growing at a ~33% CAGR (see above) while Internet bandwidth is only increasing ~20% per year, most new data will necessarily be stored in edge data centers rather than in centralized public clouds. IDC estimates that at least 40% of Internet of Things (IoT) created data will be stored, processed, analyzed and acted upon close to, or at the edge of, the network by 2019. Cisco estimates that the majority of database, analytics, big data, BI, ERP and other enterprise workloads stay in private data centers in 2020. These workloads are ideal for our data platform. We see an enormous opportunity across our customer base as IoT (alone a $6 billion opportunity in edge data centers by 2020), factory automation, healthcare/biotech, and logistics, as well as other real-time control systems, do not fit in the public cloud.

- Secular shift to flash memory: In the most recent quarter, we had more than one customer running large scale simulations and analytics to replace over 20 racks (think 20 refrigerators of equipment) with a single FlashBlade (at 4 rack units, about the size of a microwave oven). Such dramatic consolidation depends on storage software that has been designed for silicon rather than mechanical disk. And estimates are that 90% of the inevitable transition from hard drives to solid-state memory is still in front of us.

- Secular shift to cloud computing: More than 25% of our business to date has been selling to cloud customers, call that selling into clouds #4 through #4000. We now have over 500 Software as a Service (SaaS), Consumer Internet, and Infrastructure as a Service/Platform as a Service (IaaS/PaaS) customers. Pure’s architecture follows the model employed in the public cloud in that it is multi-tier (greater performance and efficiency), is fully automated, and is software-driven but accelerated by commodity silicon. Yet, as our cloud customers tell us, Pure Storage offers higher performance and higher quality of service at a lower cost.

- A $35 billion market opportunity: We have just started to disrupt our total addressable market of $35 billion. According to Pacific Crest Securities, the big three public cloud providers in AWS, Azure and Google Cloud will grow to about 15% of the overall IT market by 2020. While remarkable, that still leaves the lion’s share of the market available to Pure, most all of which we are convinced will move toward all-flash and cloud-capable storage.

- Analytics as a key growth market: Pure’s business has long been focused on three key areas – databases/business applications (Oracle, Microsoft SQL Server, SAP); virtualization (VMware, HyperV, OpenStack); and VDI (VMware View and Citrix). In 2017, we see a massive growth opportunity in analytics, both classic and next-generation approaches. The combination of FlashBlade and FlashArray accelerate both traditional analytics such as Oracle OLAP, SAP Hana and SAS, as well as next-gen platforms like Splunk and Apache Spark. Analytics broadly is a $130 billion infrastructure market, and one that will be key to the Pure go-to-market engine in 2017.

- Evergreen subscription business model: Unlike our competitors, Pure comes with an evergreen subscription to future innovation. We design our products with perpetual forward compatibility, so customers never find themselves at a dead end, forced to repurchase the same storage and disruptively migrate their data. Instead, Pure seamlessly evolves underneath customer data with no impact to the business other than improved performance and higher quality of service. This year’s transition to NVMe will be eye-opening for customers – many of whom have become accustomed to the painful repurchase and forklift cycles of their incumbent vendors.

- Breaking down the application silos with a data platform: To thrive, businesses must mine their data for predictive insights, yet often it is the slowness, expense, fragility, and complexity of storage that holds them back. In legacy storage, data is often mapped to a single application rather than enabling data sharing across many applications. In enabling our customers to derive far more value from their data across many more applications, we have become indispensable. You can especially see that with the hundreds of customers that have spent more than $1 million with us.

Let me close with thanks to all of the customers, partners, investors and employees that have joined Team Orange on our extraordinary journey. We look forward to Pure’s best year yet with compelling product innovations (across FlashArray, FlashBlade, Pure1 and FlashStack converged infrastructure) that will further distance us from the pack and help us cross over the $1 billion in revenues threshold.

Forward Looking Statements. This post contains forward-looking statements regarding industry and technology trends, our unique strategy, positioning and opportunity, our products and related roadmaps (including for FlashArray and FlashBlade), the impact of NVMe, the benefits of our approach and cost advantages, competition, traction with partners, and our business and operations, including our future margins, growth prospects and operating model. Forward-looking statements are subject to known and unknown risks and uncertainties and are based on potentially inaccurate assumptions that could cause actual results to differ materially from those expected or implied by the forward-looking statements. Actual results may differ materially from the results predicted, and reported results should not be considered as an indication of future performance. The potential risks and uncertainties that could cause actual results to differ from the results predicted include, among others, those risks and uncertainties included under the caption “Risk Factors” and elsewhere in our filings and reports with the U.S. Securities and Exchange Commission, including, but not limited to, our Quarterly Report on Form 10-Q for the quarter ended October 31, 2016, which are available on our investor relations website at investor.purestorage.com and on the SEC website at www.sec.gov. Additional information will also be set forth in our Annual Report on Form 10-K for the fiscal year ended January 31, 2017. All information provided in this release and in the attachments is as of March 1, 2017, and we undertake no duty to update this information unless required by law.

Non-GAAP Financial Measures. This post contains certain non-GAAP financial measures about the company’s performance. For the most directly comparable GAAP financial measures and a reconciliation of these non-GAAP financial measures to GAAP measures, please see our earnings release issued on March 1, 2017, which includes tables captioned “Reconciliations of non-GAAP results of operations to the nearest comparable GAAP measures” and “Reconciliation from net cash provided by operating activities to free cash flow.”

Written By: