Since starting Pure Storage (NYSE:PSTG), we’ve taken a broad view of the market opportunity for Flash. We eschewed the idea that Flash was a niche performance technology, and built a company and a product strategy around delivering flash everywhere to power mainstream computing and tomorrow’s clouds. We built our initial success targeting the core SAN segment of the storage market, but over the past few years we have been investing in a number of expansion opportunities. These expansion opportunities are now shipping and are poised to transform even more of the storage market, and dramatically expand Pure’s market opportunity in 2016, 2017, and beyond. This blog recaps these technology investments (at least the ones we’re ready to talk about!), and hopefully gives a sense for how Pure is keeping-up our aggressive growth trajectory in the overall moderate-growth storage market.

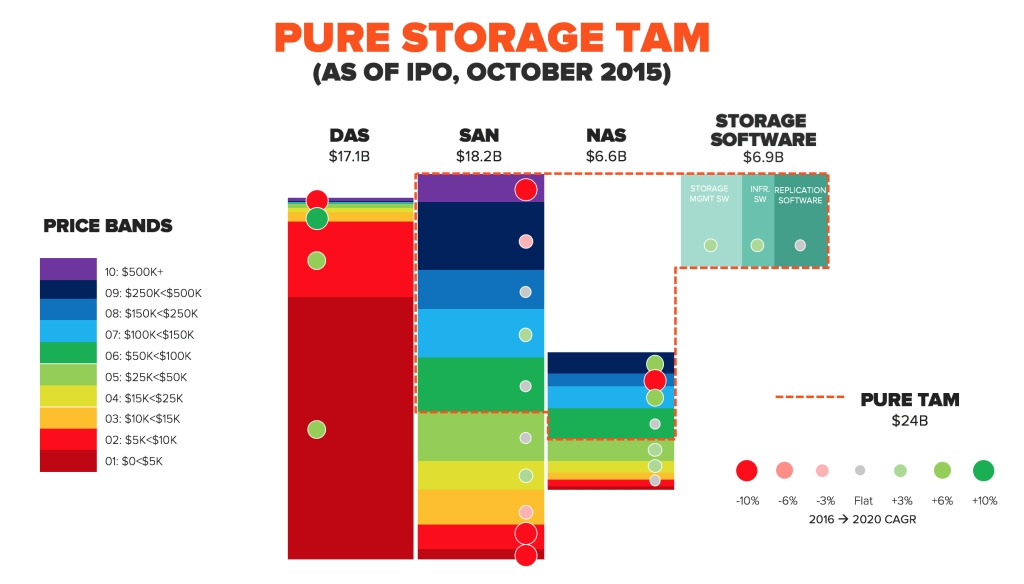

Pure’s 2015 TAM: $24B

As part of our IPO in October 2015, we defined the TAM our solutions served. Using industry-standard IDC data for price bands, we calculated that TAM to be approximately $24B annually:

Our calculus in 2015 was pretty simple:

- We included SAN storage (Fibre Channel and iSCSI-networked) in the $50K+ price bands, with the exception of mainframe-attached storage since we don’t make a mainframe-compatible product.

- We included NAS storage (Ethernet-networked, file protocol) in these price bands as well, as we anticipated adding NAS protocols to our products, and we often see NAS customers switch to SAN given the simplicity of Pure for virtualization and application environments.

- We included the storage software markets for storage management, storage infrastructure, snapshots, and replication software, software that we bundle and include with Pure purchases.

The rectangles in the diagram above give the relative sizes of each of these price bands, and the circles give a sense for the growth rate for each of these sub-segments.

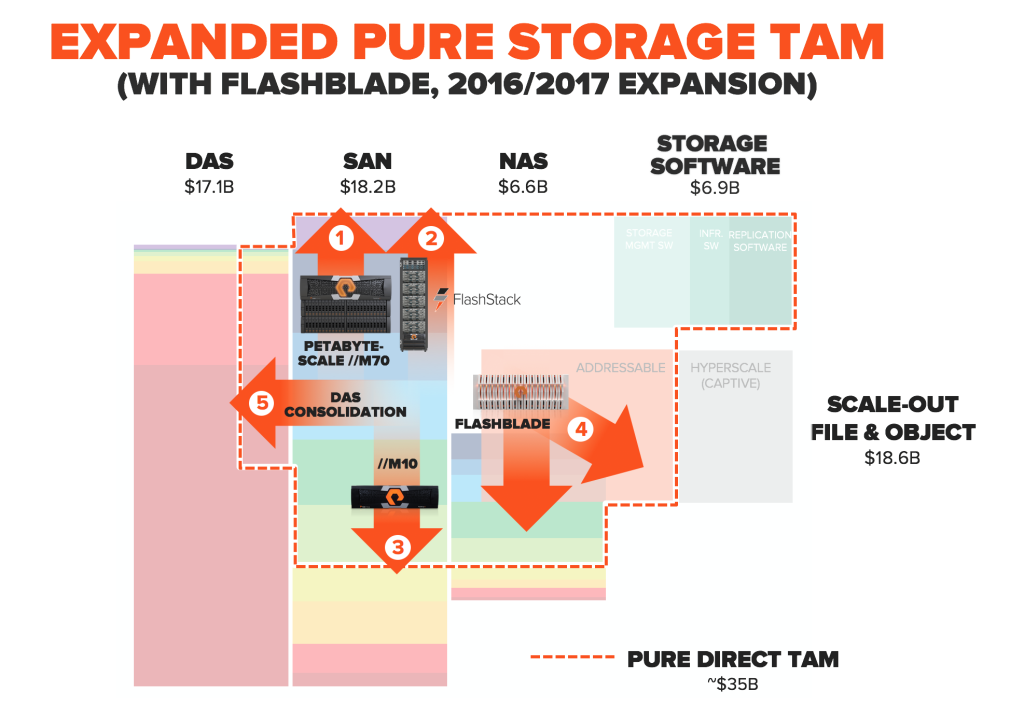

Smart Storage Pure’s 2016/2017 TAM: $35B

We introduced new products in 2016 and have new initiatives coming in 2017 that we are confident will continue the transformation of storage. These significantly expand our TAM, and help us gain share faster in our existing TAM. Specifically:

- Moving up-market with Petabyte-scale FlashArray//Ms for widespread workload consolidation,

- Delivering converged solutions with Cisco with our joint FlashStack Converged Infrastructure product line,

- Moving down-market with sub-$50K FlashArray//M10, selling to small-mid sized enterprises,

- Expanding into the scale-out file and object storage market with our new FlashBlade product, now shipping the DA version for revenue,

- Expanding increasingly into server-DAS workloads with the combination of FlashBlade and the coming adoption of NVMe in FlashArray.

These five expansions bring our unique simplicity, efficiency and customer experience to areas of storage that are ripe for disruption. They add a cumulative $11B to our TAM, bringing our total TAM to approximately $35B, and enable us to address this TAM at a faster clip.

Let’s explore these 5 growth areas in a bit more depth:

- Petabyte-scale //M. Our Evergreen model enables us to ship faster and denser systems, allowing our customers to take advantage of CPU and flash advances as non-disruptive upgrades. Join us later this week as we introduce new systems and software features which scale to >1PB usable capacity, and enable the next level of application consolidation on FlashArray.

- FlashStack. The converged infrastructure market continues its gangbuster growth, projected to grow 59.7% through 2019 according to IDC. Pure and Cisco’s joint solution, FlashStack, continues to take share from legacy disk-centric converged infrastructure solutions, and enables Pure to go after CI TAM, as well as compete with HCIA in the market.

- //M10. At the beginning of this year Pure introduced a new //M10 entry-level FlashArray, enabling us to better-serve the $25-$100K market. This offering not only opens-up new customer base, but is the perfect “land-and-expand” product, as it is fully-upgradable to our biggest //M as a customer’s needs grow.

- FlashBlade. There’s no expansion opportunity we’re more excited about than FlashBlade, which enables us to better-address the enterprise NAS market, as well as go after the scale-out file and object market that is tracked independently by IDC. FlashBlade is well-aligned with “big data”-type analytics use cases, IoT, and machine/log data analysis, as well as typical high-end engineering use cases such as simulation, chip design, media rendering, transcoding, genomics, and software development and regression testing.

- DAS Consolidation. Finally, we are seeing an emerging opportunity to drive consolidation of server-DAS storage (storage shipped inside or directly attached to commodity servers) into shared storage solutions, leveraging both FlashBlade and future versions of FlashArray leveraging NVMe. Many of “new-stack” applications such as Hadoop/Spark and NoSQL databases today are built upon a server-DAS (disk or flash) architecture, but this architecture breaks down in performance and manageability at scale. We see the opportunity to leverage our solutions to deliver networked storage to these use cases, at higher performance, reliability, and density, with simpler management.

Together these five TAM expansion opportunities not only expand our TAM to approximately $35B but also enable us to accelerate our execution within this TAM.

Delivering Best-in-Class Growth

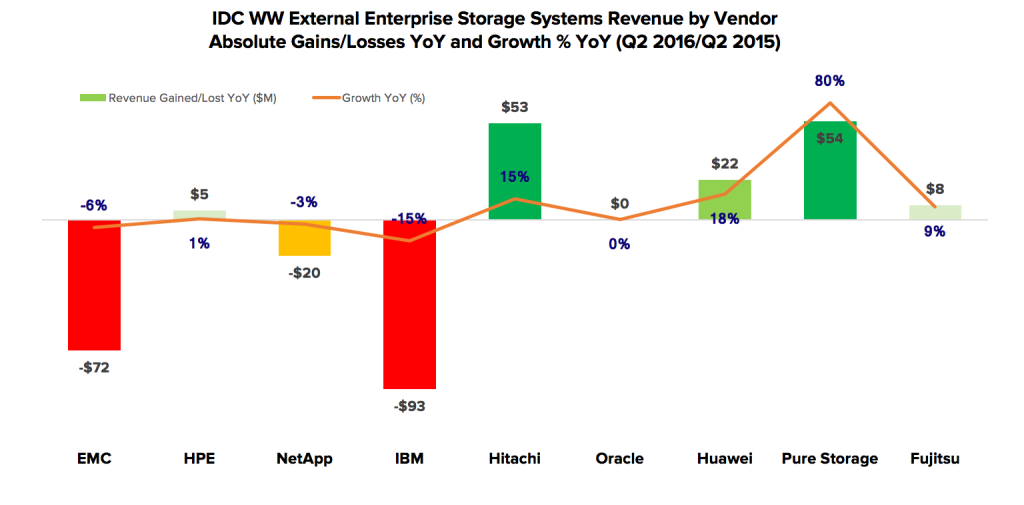

Our plan to transform storage is working, as we continue to demonstrate best-in-class growth quarter after quarter. IDC recently released its Q2 2016 enterprise storage market share numbers, and once again Pure Storage delivered best-in-industry growth by a landslide, and actually delivered the highest total revenue dollar growth in the storage industry. Not the flash industry, in the storage industry overall. This growth has enabled us to move into the top 10 vendors in the overall storage industry (while our larger competitors continue to see total market share declines as they re-arrange the deck chairs from disk to flash, but fail to change the trajectory of their overall businesses).

We are more excited than ever to be bringing flash-enabled Smart Storage solutions to all corners of the storage industry, and you can rest assured we won’t quit until every workload in tomorrow’s data center can reap the efficiency, simplicity, and performance benefits of Pure Storage!

Try out FlashBlade

Forward Looking Statements. This post contains forward-looking statements regarding industry and technology trends, our strategy, positioning and opportunity, and our products (including FlashArray and FlashBlade), business and operations. Forward-looking statements are subject to known and unknown risks and uncertainties and are based on potentially inaccurate assumptions that could cause actual results to differ materially from those expected or implied by the forward-looking statements. Actual results may differ materially from the results predicted, and reported results should not be considered as an indication of future performance. The potential risks and uncertainties that could cause actual results to differ from the results predicted include, among others, those risks and uncertainties included under the caption “Risk Factors” and elsewhere in our filings and reports with the U.S. Securities and Exchange Commission, including, but not limited to, our Quarterly Report on Form 10-Q for the fiscal year ended July 31, 2016, which is available on our investor relations website at investor.purestorage.com and on the SEC website at www.sec.gov. Additional information will also be set forth in our Quarterly Report on Form 10-Q for the quarter ended October 31, 2016. All information provided in this post is as of October 11, 2016, and we undertake no duty to update this information unless required by law.