Pure Storage’s innovations deliver the ideal storage platform for data-driven and cloud computing, because we help our customers better take advantage of the astonishing accumulation of data within almost every field of human endeavor. Check out Pure’s Q1 2017 results!

To illustrate, I’ll share how three customers are using Pure to transform their businesses. All three customers have deployed both FlashArray and FlashBlade:

The first is building one of the premier artificial intelligence (AI) platforms in the world on Pure.

Let’s dig in on the first use case. One of the storage challenges in supporting next-generation AI is to provide a platform that offers both high ingest rates and very fast access to the data, but does so in a small footprint (high density). We got it right. As a result, our customers are using our data platform for new workloads like facial recognition, autonomous driving, genomic sequencing, medical diagnostics, aerospace simulation, textual analysis, modern software development, chip design, advertising optimization, security assessment, and many more. Several of the aforementioned leverage AI techniques including deep learning that depend upon massive parallelism. Our legacy competitors are simply not a fit for such bandwidth intensive applications, because their disk-centric designs, even when retrofitted with all-flash, are big and slow (performance drops to hard drive levels as the underlying SSDs get larger). Pure’s purpose built all-flash data platform is instead big and fast (a fun illustration of parallelism can be found here), positioning us to better serve an expected $6 billion market for AI-associated storage in 2020.

A Fortune 50 enterprise customer, continues to migrate their operating infrastructure to Pure, now with more than 100 petabytes of data on our platform.

The enterprise customer with more than 100 petabytes on Pure is building a simple, agile and evergreen private cloud that offers a higher quality of service at lower cost than public cloud alternatives. This customer expanded their initial use of Pure for accelerating databases to standardizing on FlashArray for block storage and leveraging FlashBlade for big data analytics. The benefits of consolidating on Pure compound at scale, as simplicity, power and space efficiency, as well as elimination of downtime and data migrations, transform the customer experience. As a result, Pure now serves nearly 25% of the Fortune 500. Again, our legacy rivals come up short, offering solutions that are too labor intensive, too difficult to scale, and that require rebuying the same storage over and over, and disruptively migrating data year round.

A Midwest municipality leverages Pure to provide superior citizen safety and services.

And last but not least, the City of Davenport, Iowa has been running their mission-critical 911 emergency and other citizen-facing applications on FlashArray for years, and recently purchased FlashBlade for a variety of unstructured data use cases, including capturing video from body cameras. Davenport’s story illustrates how Pure provides simple, fast, highly available storage to customers of all sizes.

Together, these customers paint a picture of why Pure is delivering sustained growth: Whether you are a leading tech company pushing the envelope in AI, a Fortune 50 enterprise looking to increase operating efficiencies with hybrid cloud, or a municipality seeking to better serve your citizens, Pure has the answer.

First quarter (Q1 2017) results

Such successes and many more like them are embodied in our first quarter results. Pure’s revenues were $183 million, beating the midpoint of our guidance by 4%, and setting us up to deliver $1 billion in revenues this year, in just our sixth year of selling. At the same time, we continued our march toward profitability, with solid operating margins in a seasonal investment quarter, 8 percentage points above the midpoint of our guide and 12 points better than a year ago. We continue to expect to crossover to cash flow positive in this year’s second half. With $536 million in cash and investments on the balance sheet and zero debt, we have the financial resources we need to build the leading data platform globally.

Hybrid cloud is the future. Pure’s customers are continuing to invest in their own data centers, while turning to the public cloud for specific use cases. One simple reason is that data is growing far faster than Internet bandwidth. Current estimates are that ~50 Zettabytes (ZBs)[1] of data will be created in 2020, but the total Internet traffic for that entire year will be only ~2.5ZB[1], meaning that at most 5% of the newly generated data could traverse public networks to the cloud assuming the entire Internet was so dedicated. Couple this with the increasing need for real-time automation, such as on the factory floor, in the hospital, or in the logistics network where even milliseconds count.

Pure sees a significant opportunity in data centers built at both the core and edge of the network. Data produced on the “edge,” like sensor output from Internet of Things (IoT) devices, will necessarily be stored in data centers outside the public cloud or on devices themselves. And data has real gravity – it is generally more cost effective to analyze it locally than to move it to/from the cloud. A case in point: Amazon’s warehouses contain mini data centers to provide greater bandwidth and lower latency to their local operations. Pure is building a growth business with IoT “edge” data centers, some of which are implementing similar coprocessing with the public cloud.

Given our success with new workloads and in the cloud (>25% of Pure’s revenues to date are supporting SaaS, IaaS, and the consumer Internet), Pure remains hugely bullish on the road ahead. Public clouds, constrained by narrow wide area networks, simply cannot support data driven use cases at the edge, and legacy storage systems lack the performance, cloud automation and cloud business model needed for success in the 21st century.

As evidence, our first quarter win rates improved versus our top three competitors, Dell EMC, HP Enterprise and NetApp. Customers choose Pure Storage for better performance, reliability, and simplicity as well as lower total cost of ownership. Much has already been made of the advantages we provide versus the disk-centric designs of our legacy competitors (e.g., see our blog post on making NVMe mainstream or our EMC World competitive update). However, Pure’s primary and sustainable advantage is our software: It is nearly impossible to transform code designed for hard drives that can only do one thing at a time to instead maximize parallelism within as well as across devices. And it is nearly impossible to shed decades of accumulated complexity. In our view, the only way to close this gap will be to rewrite the storage software – and that takes years. What is more, getting there will still require customers to rip and replace all of the current gear. Only Pure is protecting our customers’ investments for the next decade and beyond.

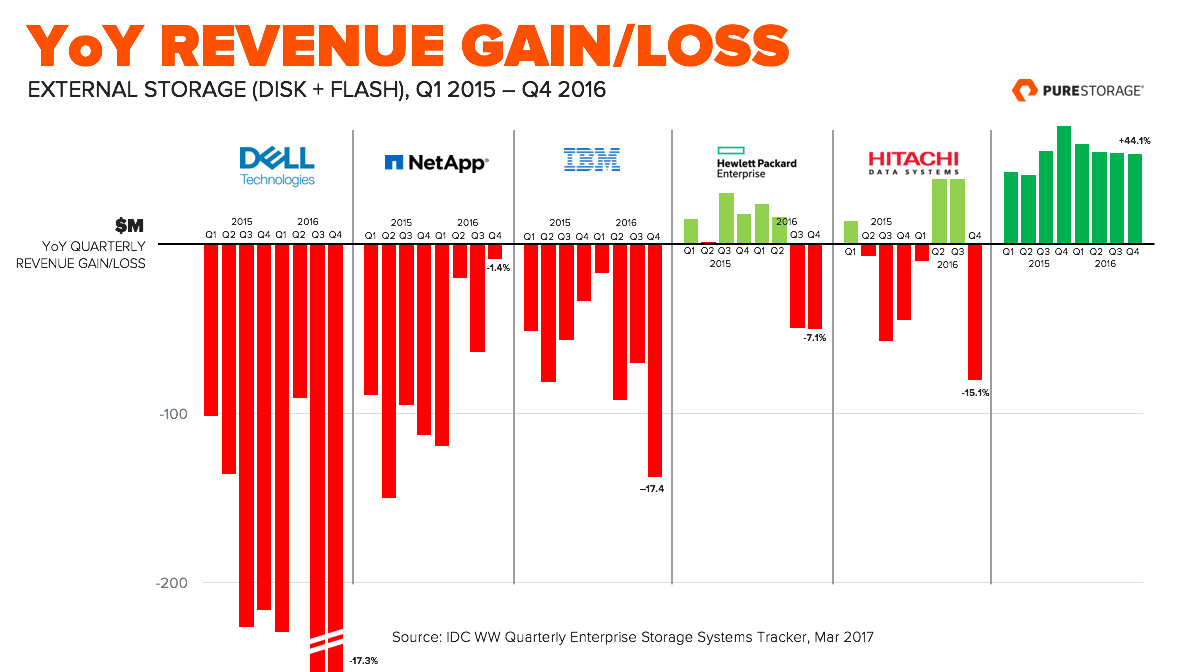

The transition to data-driven and cloud computing is already impacting storage industry market share, with Pure (now a top ten global vendor) and public cloud both gaining while legacy solutions are in decline. IDC’s analysis of the last two years of market share gains and losses is shown below, and demonstrates the stark difference between growth (Pure) and share shifting to retrofitted all-flash within a shrinking installed base (our legacy competitors):

With the continuing growth in data-driven applications, the center of gravity in the data center is shifting away from compute and toward data storage. With fast networking and remote storage now performing like local storage, these trends will accelerate in the months and years ahead. As a result, Pure has joined growth bellwethers like Arista and Palo Alto Networks as differentiated, cloud-capable infrastructure for those building their own clouds (think Clouds #4 – #1000), for data-driven workloads on the edge, as well as for bringing the benefits for the cloud to Enterprise IT. Wouldn’t your own business be better served by a data platform designed for the data-driven and cloud-centric future, one whose best years are ahead rather than behind? See why our customers are already using the mantra “No one gets fired for buying Pure Storage” – or better yet “I got promoted for buying Pure!”

Forward-Looking Statements. This post contains forward-looking statements regarding industry and technology trends, such as AI and edge datacenters, our unique strategy, positioning and opportunity, our products and related roadmaps (including for FlashArray and FlashBlade), the impact of NVMe, the benefits of our approach and cost advantages, competition, and our business and operations, broadly including our future revenue, margins, growth prospects and operating model. Forward-looking statements are subject to known and unknown risks and uncertainties and are based on potentially inaccurate assumptions that could cause actual results to differ materially from those expected or implied by the forward-looking statements. Actual results may differ materially from the results predicted, and reported results should not be considered as an indication of future performance. The potential risks and uncertainties that could cause actual results to differ from the results predicted include, among others, those risks and uncertainties included under the caption “Risk Factors” and elsewhere in our filings and reports with the U.S. Securities and Exchange Commission, including, but not limited to, our Annual Report on Form 10-K for the year ended January 31, 2017, which are available on our investor relations website at investor.purestorage.com and on the SEC website at www.sec.gov. Additional information will also be set forth in our Quarterly Report on Form 10-Q for the quarter ended April 30, 2017. All information provided in this release and in the attachments is as of May 24, 2017, and we undertake no duty to update this information unless required by law.

Non-GAAP Financial Measures. This post contains certain non-GAAP financial measures about the company’s performance. For the most directly comparable GAAP financial measures and a reconciliation of these non-GAAP financial measures to GAAP measures, please see our earnings release issued on May 24, 2017, which includes tables captioned “Reconciliations of non-GAAP results of operations to the nearest comparable GAAP measures” and “Reconciliation from net cash provided by operating activities to free cash flow.”

[1] Source: IDC White Paper, sponsored by Seagate, Data Age 2025, April 2017

[2] Source: Cisco VNI Global IP Traffic Forecast, 2015-2020